Getting prescribed a medication only to find out your copay is $150 a month can feel like a punch in the gut. You’re not alone. Millions of people on Medicare Part D and other private insurance plans face this exact problem every year. But here’s the thing: if your drug is already on your plan’s formulary, you might not have to pay that high price. You can ask for a tier exception - and many people do it wrong, or don’t do it at all.

What Is a Tier Exception?

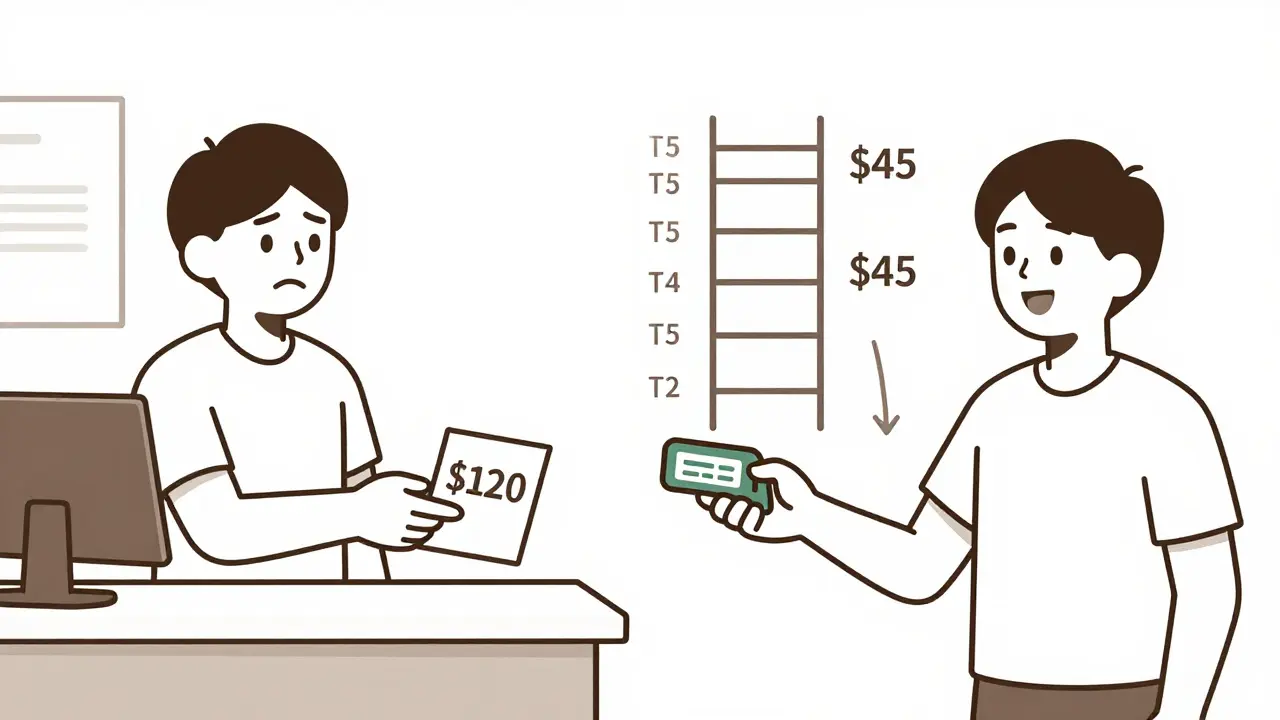

A tier exception is a formal request to your insurance plan to move a medication from a higher-cost tier to a lower one. It doesn’t mean getting a drug that’s not covered. It means getting the drug you need at the price of a cheaper alternative. Most insurance plans use a tiered system for drugs. Think of it like a pricing ladder:- Tier 1: Generic drugs - often $0 to $10 copay

- Tier 2: Preferred brand-name drugs - $10 to $40 copay

- Tier 3: Non-preferred brand-name drugs - $50 to $100 copay

- Tier 4: Preferred specialty drugs - 20% to 30% coinsurance

- Tier 5: Non-preferred specialty drugs - 30% to 40% coinsurance, sometimes over $1,000/month

Why Do Tier Exceptions Work?

Insurance companies put drugs on higher tiers because they didn’t negotiate a good price with the manufacturer. That doesn’t mean the drug is worse. It just means the company paid less for the cheaper ones. A tier exception says: “This drug isn’t just a preference - it’s medically necessary for this patient.” For example:- A patient with rheumatoid arthritis needs Humira, but their plan lists it on Tier 4 ($150 copay). They request a tier exception. The doctor explains why methotrexate (a Tier 1 drug) caused liver damage. The request is approved. Humira moves to Tier 2 - now it’s $45.

- Someone on Xarelto for atrial fibrillation gets hit with a $120 copay. They ask for a tier exception. Their doctor notes they had a major GI bleed on warfarin. The plan approves the exception and moves Xarelto to Tier 2 - saving $80 per month.

Who Can Request a Tier Exception?

You, your doctor, or someone helping you (like a family member or patient advocate) can start the request. But here’s the catch: your doctor must sign off. Insurance companies won’t approve a tier exception based on your word alone. They need a clinical reason from your prescriber. That means you need to talk to your doctor about this - not just assume they’ll do it. Many doctors don’t bring this up because they’re busy. Don’t wait for them. Ask: “Can we file a tier exception for this drug? I can’t afford the copay.”How to Get a Tier Exception Approved

There’s a right way and a wrong way to do this. Most denials happen because the paperwork is weak. Here’s what works:- Get the right form. Your insurance plan has a specific tier exception form. Don’t use a generic letter. Go to your plan’s website or call customer service and ask for the “Tier Exception Request Form” or “Coverage Determination Form.”

- Work with your doctor. They need to complete the medical necessity section. This isn’t a checkbox. They must explain why other drugs won’t work.

- Use specific clinical language. Avoid vague statements like “Patient doesn’t tolerate the alternative.” Instead, say: “Patient developed severe gastrointestinal bleeding on warfarin, requiring hospitalization. Switching to Xarelto was medically necessary to prevent recurrence.”

- Submit early. Request the exception before filling the prescription. If you fill it first, you’ll pay full price and then wait for reimbursement - which can take weeks.

- Follow up. Plans have 14 days to respond for standard requests. If you’re sick and can’t wait, ask for an “expedited review” - they must respond in 72 hours.

Why Most Requests Get Denied - And How to Fix It

About 37% of initial tier exception requests are denied - not because they’re invalid, but because the documentation is too thin. Common mistakes:- “I can’t afford the other drugs.” - Not a medical reason.

- “My doctor says it’s better.” - Too vague. What does “better” mean?

- “I’ve been on this drug for 5 years.” - Doesn’t prove it’s necessary now.

- Failure or intolerance of lower-tier alternatives

- Adverse effects from switching

- Specific clinical evidence (lab results, hospitalizations, side effects)

Real Stories: What Works

On Reddit, one user wrote: “My Humira was $150/month. My doctor submitted the form with my joint damage scans and lab results showing inflammation. Approved in 10 days. Now it’s $45.” Another said: “I tried twice for Xarelto. First denial said my doctor didn’t explain why warfarin was dangerous. Second time, he added my INR logs and ER visit history. Approved to Tier 2. Still pay $40, but that’s $80 less than before.” The Medicare Rights Center surveyed 1,200 people. 58% succeeded. The average monthly savings? $37.50. That’s $450 a year per drug.When Tier Exceptions Don’t Help

Tier exceptions only work if your drug is already on your plan’s formulary. If it’s not covered at all, you need a formulary exception - a different process. Also, if your drug is on Tier 5 (specialty tier), you might still pay a lot - even after approval. But you’ll pay less than before. And if you’re in the coverage gap (donut hole), moving to a lower tier can keep you out of it entirely.

What’s Changing in 2025 and Beyond

Starting in 2025, the Inflation Reduction Act caps out-of-pocket drug costs at $2,000 per year for Medicare Part D beneficiaries. That’s huge. But here’s the catch: that cap applies to your total spending. If you’re paying $150/month for one drug, you’ll hit that cap faster - and your other medications will become free. But if you get that drug moved to a lower tier now, you’ll save money every month, not just after you’ve already spent $2,000. Also, more insurers are using automated tools. UnitedHealthcare’s pre-approval tool lets doctors check approval odds before submitting. Some plans now approve requests the same day if the doctor files it with the prescription.What You Should Do Right Now

If you’re taking a brand-name or specialty drug and paying more than $30 a month:- Check your plan’s formulary online. Find your drug’s tier.

- Look at the lower tiers. Is there a similar drug you could use? If not, you’re a candidate for a tier exception.

- Call your doctor’s office. Ask: “Can we file a tier exception for [drug name]?”

- Ask for the form. Fill it out. Get the doctor to sign it.

- Submit it before you fill your next prescription.

Frequently Asked Questions

Can I request a tier exception for any medication?

No. You can only request a tier exception for a drug that’s already on your insurance plan’s formulary. If your drug isn’t covered at all, you need a formulary exception instead. Tier exceptions are for drugs that are covered - but in a higher, more expensive tier than you think they should be.

How long does a tier exception take to approve?

Standard requests take up to 14 days. If your doctor says your health is at risk without the drug - for example, if you’re about to stop treatment or have worsening symptoms - you can ask for an expedited review. That must be decided within 72 hours. Most approvals come in under a week if the paperwork is complete.

What if my tier exception is denied?

You can appeal. About 37% of initial requests are denied - often because the doctor’s note was too vague. On appeal, you can submit more detailed medical records, lab results, or a second letter from your doctor. About 78% of appeals with stronger documentation get approved. Don’t give up after the first denial.

Does my doctor have to pay for this?

No. The request is free for you and your doctor. Insurance plans are required to provide the forms and process the request at no cost. Some doctor’s offices charge a fee for paperwork, but that’s not standard. Ask if there’s a charge before you agree to pay.

Can I get a tier exception for a new prescription?

Yes - and you should. The best time to request a tier exception is right after your doctor writes the prescription, before you fill it. That way, you pay the lower price from day one. Waiting until after you’ve paid full price means you’ll have to wait for reimbursement, which can take weeks.

Do all insurance plans offer tier exceptions?

Yes. All Medicare Part D plans and most private insurance plans use tiered formularies and allow tier exceptions. This is a federal requirement under Medicare Part D rules. If your plan says they don’t offer them, they’re wrong. Ask for the form in writing and escalate if needed.

Will a tier exception affect my future coverage?

No. A tier exception doesn’t change your plan’s rules for other people. It only changes your personal cost-sharing for that specific drug. It won’t make your plan more expensive for you later, and it won’t limit your access to other medications. It’s a one-time adjustment for your medical needs.

8 Comments

Alex Fortwengler

January 12 2026

Bro this is all a scam. Insurance companies *want* you to pay $150 so they can later say 'oh we approved your exception' and look like heroes. They make you jump through hoops on purpose. I saw a guy get denied 3 times before they 'approved' it - turns out the drug was switched to Tier 2 the week after he paid $450 out of pocket. They profit from your suffering. Don’t trust any of this. Call the CEO directly. They’ll answer. I did.

jordan shiyangeni

January 13 2026

It is both morally and clinically indefensible that patients are forced to navigate this labyrinthine bureaucracy simply to access life-sustaining medication. The very architecture of tiered formularies reflects a systemic devaluation of human health in favor of corporate profit margins - a grotesque inversion of medical ethics. Furthermore, the notion that a physician’s clinical judgment must be reduced to a checkbox on a form, subject to administrative review by non-clinical personnel, is not merely inefficient - it is an affront to the sanctity of the doctor-patient relationship. One must ask: when did medicine become a spreadsheet?

Abner San Diego

January 14 2026

USA still the worst for healthcare. I went to Canada last year for my insulin - paid $30 CAD. Back home? $400. They got a whole system. We got spreadsheets and middle managers. This tier exception crap? Just another way to make you feel like you’re winning while they still take your rent money. I don’t care if you get it approved - it’s still a rigged game. And don’t even get me started on how they charge you for the damn form.

Eileen Reilly

January 14 2026

ok but like… my doc just said ‘we’ll try’ and then ghosted me for 3 weeks 😭 i had to email their office 5 times. i printed the form, filled it out myself, and handed it to them with a highlighter on the ‘medical necessity’ part. they finally signed it… but not before i paid $120 for the first month. now im just waiting for reimbursement. also i cried in the pharmacy. not proud of it. but it was worth it. 💔💊

Monica Puglia

January 15 2026

Hey, if you’re reading this and you’re scared to ask your doctor - you’re not alone. I used to think it was too awkward. Then I said, ‘I can’t afford this. Can we try the exception?’ and they actually looked relieved. Like, ‘oh thank god you asked.’ Seriously. Doctors are overworked. They don’t know your budget. But if you say it plainly? They’ll help. You’ve got this. 🤍

Rebekah Cobbson

January 16 2026

Just wanted to add - if your first denial comes back with vague feedback like ‘insufficient clinical justification,’ don’t panic. Go back to your doctor with the denial letter. Highlight exactly what they’re asking for. Often it’s just one more lab result or a note about a previous hospitalization. I’ve helped three friends get approvals just by printing out the denial and saying, ‘What do they need to see?’ It’s not magic. It’s paperwork. And you’re worth the effort.

Audu ikhlas

January 17 2026

you people are weak. in my country we dont cry about copays. we just take what we need and dont ask for permission. this tier thing is american weakness. why not just go to mexico? pills cost 10 dollars there. or just steal from the hospital? i did. no one got hurt. but you? you sit there filling forms like serfs. pathetic.

Sonal Guha

January 18 2026

My doc filed it. Got denied. Submitted appeal with my ER visit logs. Approved in 5 days. Now pay 35 instead of 140. No drama. Just facts.