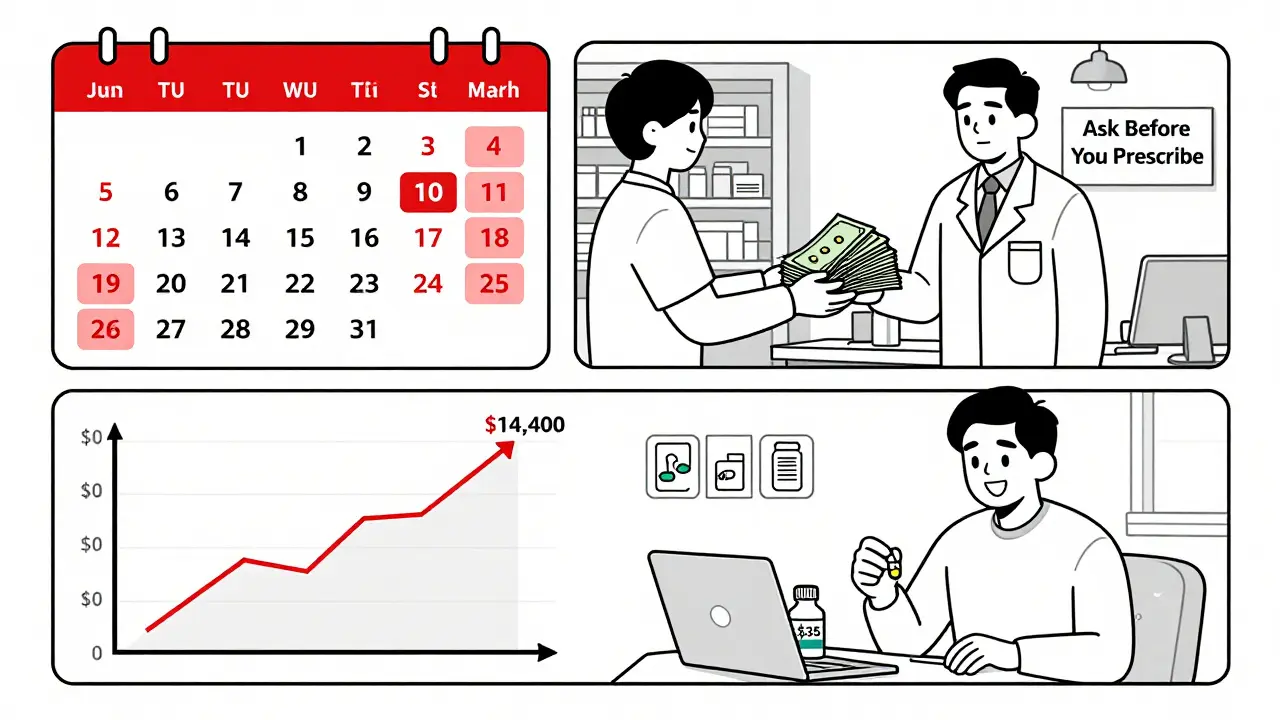

Imagine this: you leave your doctor’s office with a new prescription, feeling hopeful. But when you get to the pharmacy, the pharmacist tells you the copay is $350. You didn’t expect that. You didn’t even know it could be that high. So you walk out without it. That’s not rare. About 22% of people skip filling prescriptions because of cost, according to 2023 GoodRx data. But it doesn’t have to be this way. Talking about cost before you even write the prescription can save you hundreds-or even thousands-of dollars a year.

Why Cost Talks Matter Before You Get the Script

Most people think the doctor decides the medication, and the pharmacy just fills it. But that’s backwards. The real decision point happens when the doctor is about to click "Prescribe." That’s your chance to ask: How much will this cost me? If you wait until you’re at the pharmacy, you’ve already lost control of the situation. Studies show patients who talk about cost with their provider are 37% less likely to skip doses because of price, according to the Journal of General Internal Medicine (2022). That’s not just about saving money-it’s about staying healthy. Skipping pills because you can’t afford them leads to worse outcomes, more ER visits, and higher long-term costs. The rules changed in 2025. Under the Inflation Reduction Act, Medicare Part D now has a hard cap of $2,000 per year on out-of-pocket drug costs for beneficiaries. That’s down from $8,000 in 2024. And insulin? No more than $35 a month. But these protections don’t automatically apply to commercial insurance. If you’re on a private plan, you could still pay hundreds per month for specialty drugs with no annual cap.Know Your Insurance Before You Walk In

Before your appointment, spend 10 minutes checking your plan’s formulary. That’s the list of drugs your insurance covers-and how much you pay for each. Most plans divide drugs into tiers:- Tier 1: Generics. Usually $5-$15 copay.

- Tier 2: Preferred brand-name drugs. $25-$50.

- Tier 3: Non-preferred brands. $50-$100.

- Tier 4-5 (Specialty): High-cost drugs like biologics or cancer meds. Often 25-33% coinsurance, sometimes over $100 per fill.

Use These Tools Before Your Appointment

You don’t have to guess. There are tools built to help you know your costs ahead of time.- Medicare.gov Plan Finder: Updated every October for the next year’s coverage. You can compare up to 28 specific drugs across all Part D plans in your area. Use it during Annual Enrollment (October 15-December 7).

- CVS Caremark’s Check Drug Cost & Coverage: Available since 2019. Just enter the drug name and your plan info. It shows coverage status, copay, and cheaper alternatives.

- GoodRx, SingleCare, RxSaver: These apps show cash prices and coupons. One user saved $287 on blood pressure meds by showing the pharmacy a GoodRx price-even with insurance. GoodRx has about 70% market share.

- Real-Time Prescription Benefit (RTPB): This is the gold standard. It’s built into many electronic health records. When your doctor types in a prescription, the system shows your exact out-of-pocket cost in real time. As of January 2024, 72% of EHR systems use it. Ask your provider if they have it.

What to Say to Your Doctor

You don’t need to be an expert. Just ask these five questions:- Is there a generic version of this drug?

- Is this medication on my insurance’s formulary?

- What will my out-of-pocket cost be before I hit my deductible?

- Are there cheaper alternatives that work just as well?

- Do you know about any patient assistance programs or mail-order options?

What to Do If Your Drug Isn’t Covered

If your prescription isn’t on the formulary, don’t panic. There are still options.- Ask for a prior authorization: Your doctor can submit paperwork to your insurer asking them to cover the drug anyway. About 68% of specialty drugs require this. The Patient Advocate Foundation says 68% of these cases get approved when the provider explains why the drug is medically necessary.

- Request a therapeutic alternative: Maybe another drug in the same class works just as well-and costs less. For example, if you’re on a brand-name statin, ask about atorvastatin or rosuvastatin generics.

- Check for manufacturer coupons: Many drugmakers offer savings cards. Some even cover your entire copay for the first year.

- Apply for patient assistance programs: Pharmaceutical companies run programs for low-income patients. You can find them through NeedyMeds.org or the Partnership for Prescription Assistance.

Special Cases: Insulin, Specialty Drugs, and Payment Plans

Insulin is a game-changer. Since 2023, Medicare beneficiaries pay no more than $35 per month per insulin prescription. That’s a federal rule. But if you’re on commercial insurance, check your plan. Some still charge over $100. Specialty drugs-like those for rheumatoid arthritis, MS, or cancer-are the biggest problem. They’re expensive, often require prior authorization, and have no out-of-pocket cap in commercial plans. In 2023, 42% of specialty tier drugs cost patients more than $100 per fill-even with insurance. Medicare’s new Prescription Payment Plan lets you pay monthly installments instead of one big bill at the pharmacy. It’s great if you enroll early in the year. But if you sign up in November, you only have two months left to spread your payments. That means higher monthly bills. Don’t wait until December.What Happens If You Don’t Talk About Cost

The consequences are real. A 2024 AskDocs thread had 450 comments. Almost all were variations of: "I got a script, went to the pharmacy, saw the price, and walked away." Eighty-seven percent of commenters said they’d done it before. One person skipped their diabetes meds for six months. They ended up in the hospital. CMS data shows 18% of Part D complaints are about unexpected costs. That’s not a glitch-it’s a system failure. And it’s preventable. The American Medical Association has recommended cost discussions since 2018. The American Pharmacists Association says pharmacists should step in if a patient’s out-of-pocket cost exceeds 2% of their monthly income. But responsibility doesn’t rest only on providers. You have to ask.Final Checklist: Before You Leave the Office

Here’s what to do every time you get a new prescription:- Check your plan’s formulary online before your appointment.

- Know your deductible status (how much you’ve paid so far this year).

- Ask: "Is there a generic or lower-cost alternative?"

- Ask: "What will I pay out of pocket?"

- Ask: "Can you use Real-Time Prescription Benefit to check my cost?"

- Ask: "Is there a mail-order option?"

- Ask: "Are there patient assistance programs?"

- If it’s expensive, ask for a 30-day trial before committing to a 90-day supply.

What if my insurance doesn’t cover my medication at all?

If your drug isn’t on the formulary, ask your doctor for a prior authorization. This is a formal request to your insurer to cover the drug anyway. Your provider will need to explain why it’s medically necessary. About 68% of these requests are approved when properly documented. You can also ask for a therapeutic alternative-a different drug in the same class that’s covered. Many generic or preferred brand drugs work just as well.

Can I use GoodRx even if I have insurance?

Yes, and you should always compare. Sometimes the GoodRx coupon price is lower than your insurance copay, especially for brand-name drugs or if you haven’t met your deductible. At the pharmacy, you can ask to use the GoodRx price instead of your insurance. You can’t combine them, but you can choose the cheaper option. Many people save $100-$300 per prescription this way.

Why do some drugs cost more at the beginning of the year?

If your plan has a deductible, you pay full price until you’ve spent that amount. For example, if your deductible is $500 and you haven’t paid anything yet, you’ll pay the full retail price for your meds. After you hit the deductible, you only pay your copay. That’s why January to March is the most expensive time to fill prescriptions. Plan ahead: ask your provider if you can get a 90-day supply early in the year to help meet your deductible faster.

Does Medicare Part D cover all my medications?

No. Each Part D plan has its own formulary, which lists which drugs it covers and at what tier. Plans must cover at least two drugs per therapeutic category, but they can exclude others. You need to check your plan’s formulary every year during open enrollment (October 15-December 7). Drugs can be removed from the formulary, or tiers can change. Always verify your meds are still covered before switching plans.

Are there programs to help pay for expensive medications?

Yes. Many drug manufacturers offer patient assistance programs for low-income individuals. You can find them at NeedyMeds.org or through the Partnership for Prescription Assistance. Some states also have Rx assistance programs. Nonprofits like the Patient Advocate Foundation help with appeals and financial aid. Even if you make too much for Medicaid, you might still qualify for these programs.

10 Comments

Sohan Jindal

January 15 2026

This is all government brainwashing. They want you to think you need to ask questions so you’ll feel like you’re in control-but the real goal is to make you dependent on their system. Pharmacies are owned by Big Pharma, and doctors are paid to push expensive pills. You think $35 for insulin is a win? It’s a trap. They’re conditioning us to accept crumbs so we don’t revolt.

Annie Choi

January 15 2026

YESSS this is so real I cried reading it. I used to skip my asthma meds because I couldn’t afford it-then I ended up in the ER. Now I always ask my doc: "What’s the cheapest thing that still works?" And I use GoodRx. No shame. Your health isn’t a luxury. Go ask. Do it now. You got this 💪

Mike Berrange

January 16 2026

The article is factually accurate, but the underlying assumption-that patients are rational actors with access to information-is a neoliberal fantasy. Most people don’t have 10 minutes to check formularies before a 15-minute appointment. The system is designed to fail them. And yet, the burden is placed on the patient to navigate complexity that even physicians struggle with. This is not empowerment. It’s exploitation dressed as advice.

ellen adamina

January 18 2026

I’m 68 and on Medicare. I didn’t know about the $2,000 cap until last year. My husband’s cancer med was $1,800 a month. I called my plan, asked for the NDC number, and found a cheaper tiered alternative. We saved $16k. I didn’t even know I could ask. Why isn’t this taught in high school?

Gloria Montero Puertas

January 18 2026

...and yet, people still don’t do it. They wait until they’re hemorrhaging money-and then they blame the system. But here’s the truth: you’re not a victim. You’re complicit. You didn’t research. You didn’t ask. You didn’t advocate. You just accepted the script like a good little drone. And now you’re surprised? Shocking. Truly.

Tom Doan

January 19 2026

How ironic. The article tells you to ask your doctor about cost… but the doctor’s EHR system likely doesn’t show you the real price because the pharmacy benefit manager hasn’t updated the feed in six months. And even if it did, the "real-time" data is often 48 hours out of date. So you’re being told to rely on a tool that’s fundamentally broken. Thank you for the performative solution, Mr. Journal of General Internal Medicine.

Arjun Seth

January 21 2026

USA thinks it’s smart but India knows real pain. My sister took diabetes pills every other day because she couldn’t afford both food and medicine. No one told her to ask. No one cared. You talk about tools and formularies-what about people without internet? Without phones? Without English? This is privilege talk. Real people are dying in silence.

Ayush Pareek

January 22 2026

Hey, if you’re reading this and you’re scared to ask your doctor-start small. Just say, "I want to make sure I can take this regularly." That’s all. You don’t need to be loud or perfect. Your doctor isn’t judging you. They want you healthy. And if they act like you’re bothering them? Find a new one. You’re worth the conversation.

Jami Reynolds

January 23 2026

This entire article is a distraction. The real issue is that pharmaceutical monopolies are protected by patent laws written by lobbyists. The Inflation Reduction Act is a joke-it only applies to Medicare, not commercial plans. And the "tools" listed? They’re all owned by corporations that profit from your data. You’re being sold a false sense of agency. The system is rigged. Always has been.

RUTH DE OLIVEIRA ALVES

January 23 2026

While the procedural recommendations presented herein are indeed pragmatic and aligned with contemporary healthcare navigation paradigms, one must not overlook the structural inequities embedded within the U.S. pharmaceutical reimbursement architecture. The onus placed upon the individual patient to perform cost-benefit analyses-while commendable in intent-functions as a neoliberal mechanism of responsibilization, wherein systemic failures are individualized as behavioral deficits. A truly equitable system would obviate the necessity of such labor.